"Investing is not nearly as difficult as it looks.

Successful investing involves doing a few

things right and avoiding serious mistakes"

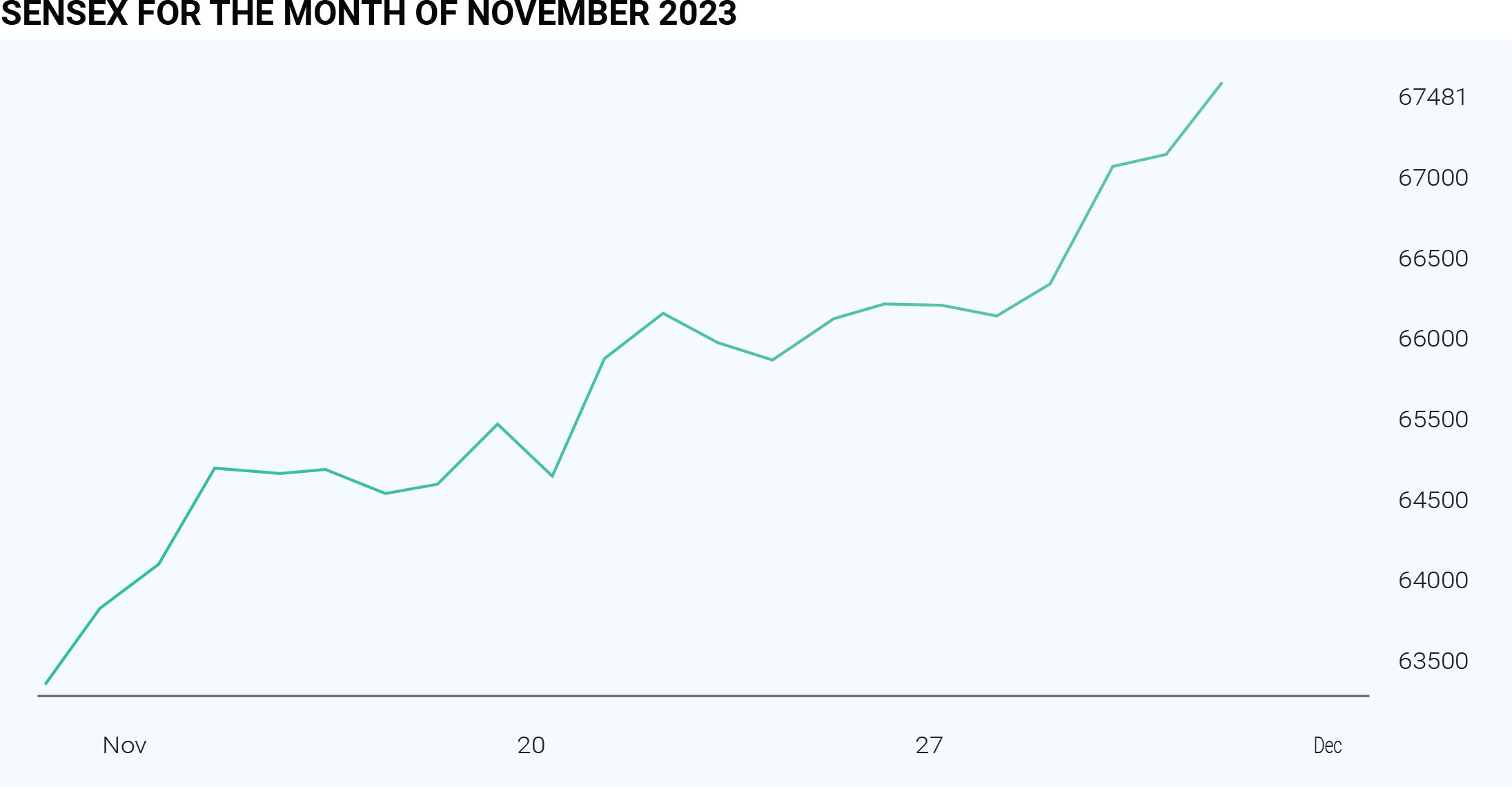

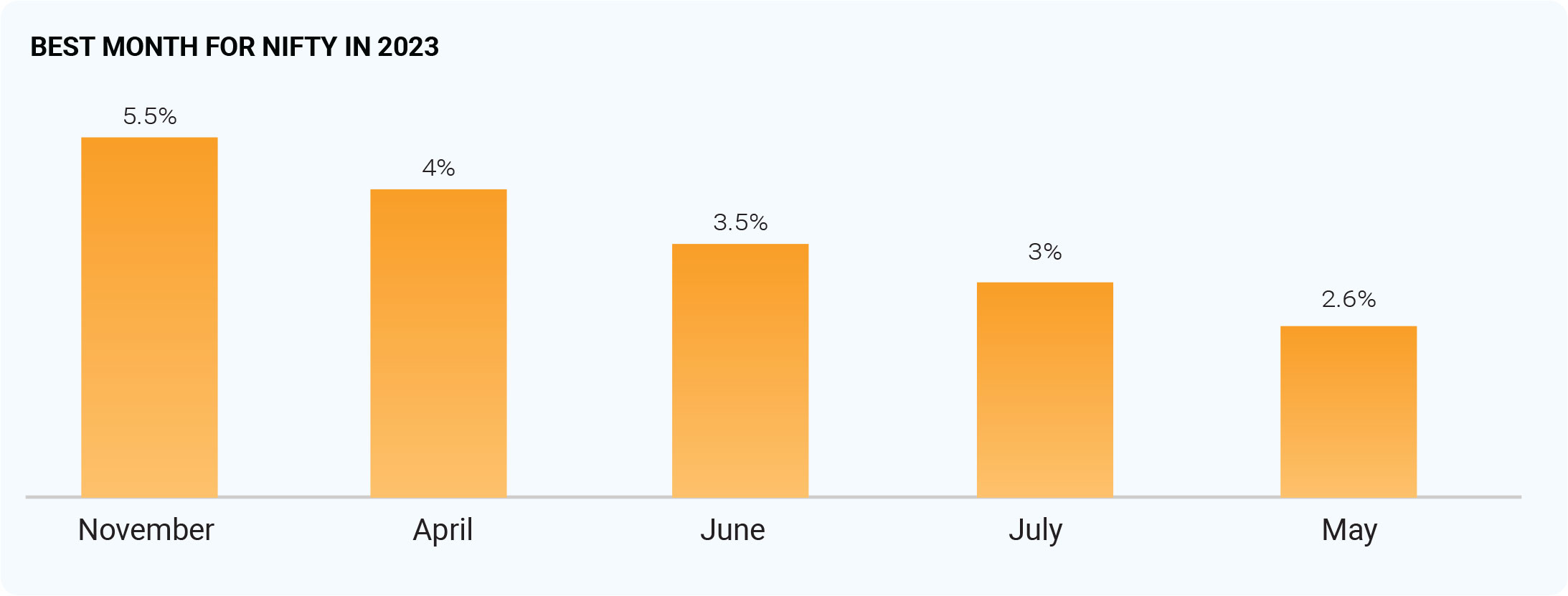

The month of November 2023 brings back the lustre

which was lost during the last 2-3 months. The festive

month started with a dreary note, but then the Nifty 50

paced up touching all-time highs. Indian stock markets

stood 4th around the world touching $4 trillion of market

capitalisation. The market valuation of BSE-listed

companies crossed a record $4 trillion for the first time

on November 29, on the back of positive market

sentiment in Indian equities. The market capitalisation of

BSE-listed companies reached ₹333 lakh crore, or $4

trillion at the exchange rate of 83.31. It has climbed over

$600 billion since the beginning of the year. BSE-listed

firms hit the $1-trillion market cap milestone in May 2007

and it took over 10 years to double. The market cap

surpassed $2 trillion in July 2017. BSE m-cap had hit the

$3 trillion mark in May 2021. Small-cap and mid-cap

categories have outperformed amid the global easing

policy actions. This was triggered post US banking crisis

and strong margin outperformance driven by input cost

moderation.

The major factors contributing to this upsurge were

robust economic numbers, favourable exit polls, and the

return of Foreign Portfolio Investors (FPIs) to the Indian

markets. The Indian economy grew by 7.6% during

Q2FY24, maintaining its position as the fastest-growing

major economy globally. India's Q2 GDP growth

surpassed both market estimates and projections by the

Reserve Bank of India. Recently, CLSA stated that it

anticipates India's soaring GDP growth will propel it to

the top three of the world’s largest economies, increasing

from $3.4 trillion today to surpass Japan’s by 2027,

reaching $29 trillion by 2047, and further expanding to

$45 trillion by 2052. By then, only China and the US will

have larger economies, with the possibility of India

overtaking the US economy in size by 2052 if significant

reforms unleash efficiencies.

The exit polls for the five state elections indicate political

stability ahead of the General Elections in 2024. A

decisive win for the BJP would strengthen the consensus

view that the party is well-positioned for the 2024 general

elections. This outcome is likely to further boost market

confidence, as policy continuity is viewed positively for

medium-term growth. The market favours political

stability and a reform-oriented, market-friendly

government."

After a two-month hiatus, Foreign Institutional Investors

(FIIs) made a comeback as net buyers of Indian equities,

injecting a total of ₹13,474 crore over only six sessions.

In November, Foreign Portfolio Investors (FPIs) ended a

two-month selling streak, recording a net inflow of

₹9,001 crore. This marked a significant shift from the

over ₹39,000 crore worth of shares sold in September

and October. Foreign portfolio investors displayed a

distinct preference for larger sectors, particularly

financials, FMCG, and oil and gas. Moreover, FPIs in the

domestic debt market reached a six-year high in

November, driven by robust yields and the inclusion of

domestic bonds in JPMorgan's Emerging Market Global

Bond Index. Data from the National Securities Depository

Ltd. reveals that foreign portfolio investors infused Rs

14,556 crore as of November 29. The decline in US

treasury yields and the softening of the dollar, coupled

with rising speculation that the US Federal Reserve has

concluded its key interest rate hikes, have triggered

foreign fund inflows into emerging markets, including

India.

Last month, global pressures took a favourable turn. Oil

prices sharply dropped to $80/bbl due to a slowdown in

the growth of China and European nations. Additionally,

the expected soon-to-be Venezuelan crude supply added

to the decline. The decrease in crude oil prices is

anticipated to help India improve its current deficit

projections. Lower-than-expected inflation readings led

to a significant correction in US bond yields. From close

to 5%, 10-year yields dropped to approximately 4.5%. This

subtle change also attracted Foreign Portfolio Investors

(FPIs) inflows. The US market rallied almost 10% in the

month of November. US 10-year bond yields and the

dollar index were cooling off, providing strength to the

market. This decline in yields gained momentum amid

growing speculation that the U.S. Federal Reserve might

initiate interest rate cuts next year. FOMC minutes stated

that in the upcoming months, data would help clarify the

extent to which the disinflation process was continuing,

aggregate demand was moderating in the face of tighter

financial and credit conditions, and labour markets were

reaching a better balance between demand and supply.

As markets reach new highs, the prevailing risk cannot

be ignored. Amid expectations that the central bank will

maintain the benchmark interest rates, the rate-setting

monetary policy panel, led by RBI Governor Shaktikanta

Das and consisting of six members, will commence

deliberations in the upcoming week. The three-day

meeting is scheduled from December 6 to December 8,

with the decision to be announced on Friday. The RBI has

held the repo rate steady at 6.5% since February of this

year. This marks the central bank's fourth MPC meeting

for fiscal 2023-24 and the final one for the calendar year

2023. The market anticipates the central bank to retain

its current stance, given that India's retail inflation

persists above its 4% target. The US Fed chairman

mentioned that inflation is steadily slowing, but it is

premature to declare victory or discuss potential interest

rate cuts. Powell reiterated the central bank's

commitment to a cautious approach on interest rates,

noting that the hoped-for 'soft landing' of the US

economy appears to be materializing. Meanwhile, global

markets, including the European Central Bank, are

experiencing bullish trends. The European Central Bank

concluded its rate-hiking cycle in response to easing

inflation.

As markets move at lightning speed, regulators are

closely monitoring derivatives traders and major sectors,

particularly banks. SEBI has issued repeated warnings to

retail investors, emphasizing the need for caution in

derivatives trading. In the Indian market, the banking

sector, a favourite among investors, has seen impressive

gains. However, the RBI is actively working to address

defaulters and implement changes in rules and

regulations.

As we approach December, several significant

challenges loom on the horizon, including the FED rate

decision, MPC meeting, global festivals, unpredictable

geopolitical tensions, and global inflation. All these

factors could potentially impact market movements in

the future. Despite these challenges, there is hope that

the year will end on a positive note for the Indian stock

markets.

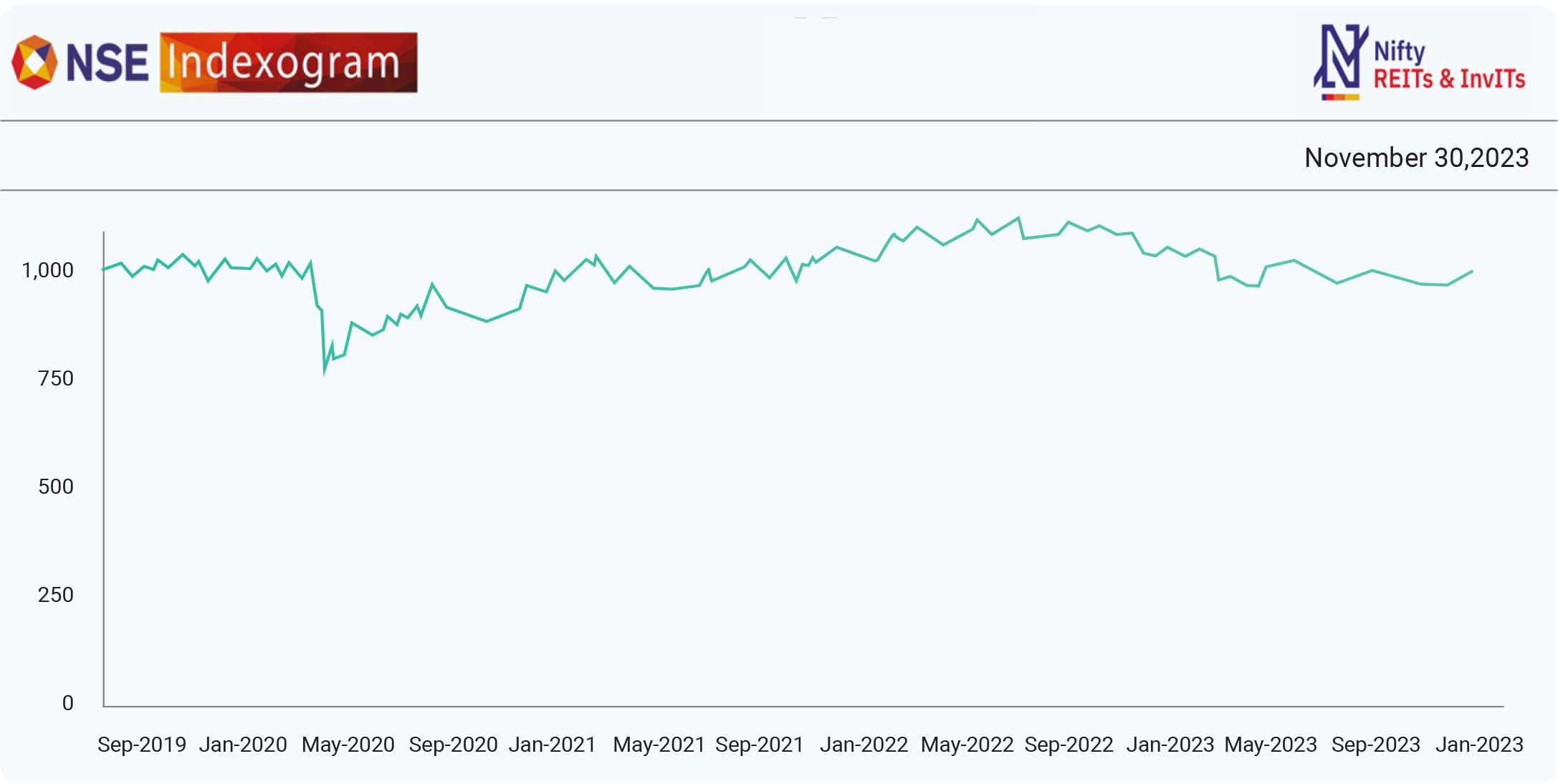

At the beginning of the current financial year, NSE Indices

Ltd, a subsidiary of the National Stock Exchange (NSE),

introduced India's first-ever Real Estate Investment

Trusts and Infrastructure Investment Trusts index — Nifty

REITs and InvITs Index. This index is designed to monitor

the performance of publicly listed and traded REITs and

InvITs on the NSE. It was a highly anticipated investment

tool for the real sector in India. The Indian government

launched InvITs and REITs to attract long-term yield

capital into the country and stimulate private

participation in infrastructure and real estate. Analysts

predict that the real estate sector in India will grow to a

market size of US$1 trillion by 2030. Despite near to

medium-term challenges from COVID-19, the long-term

drivers for real estate demand are robust and likely to

endure current adversities. The REIT/InvIT route has the

potential to address several investment challenges in the

infrastructure sector.

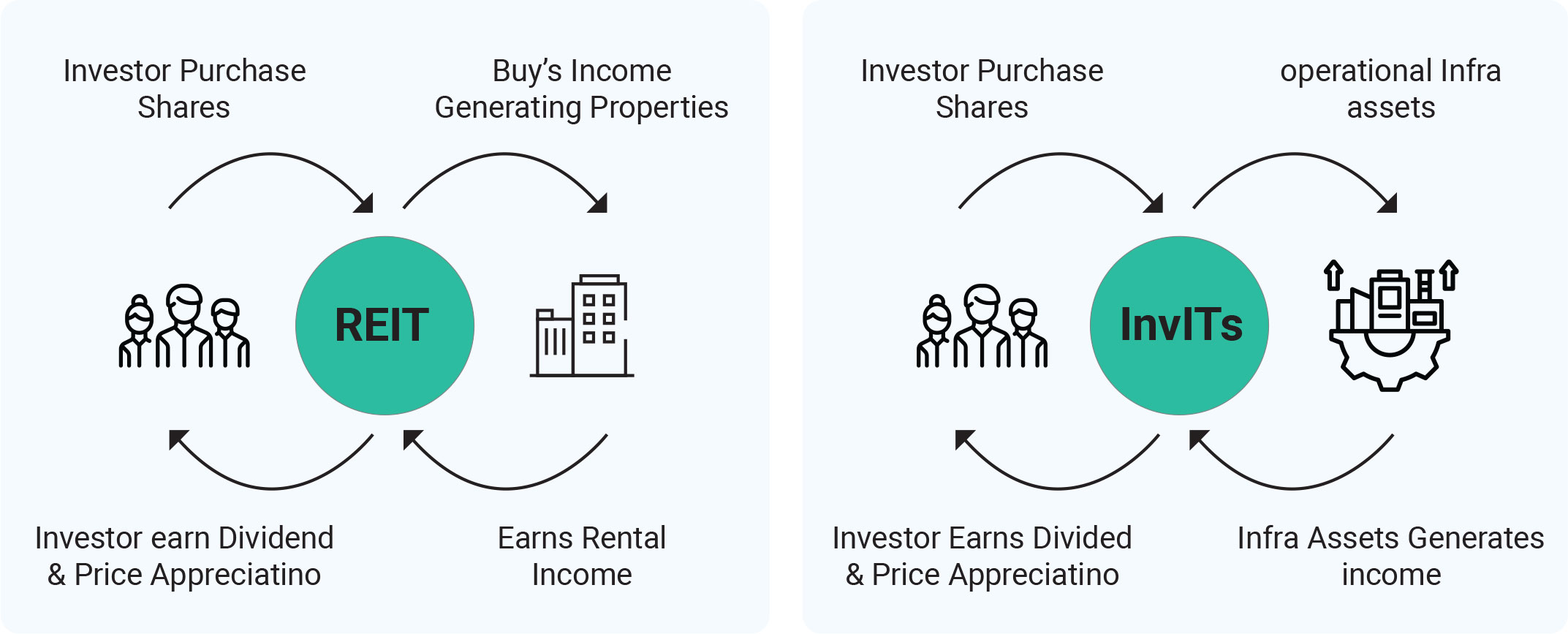

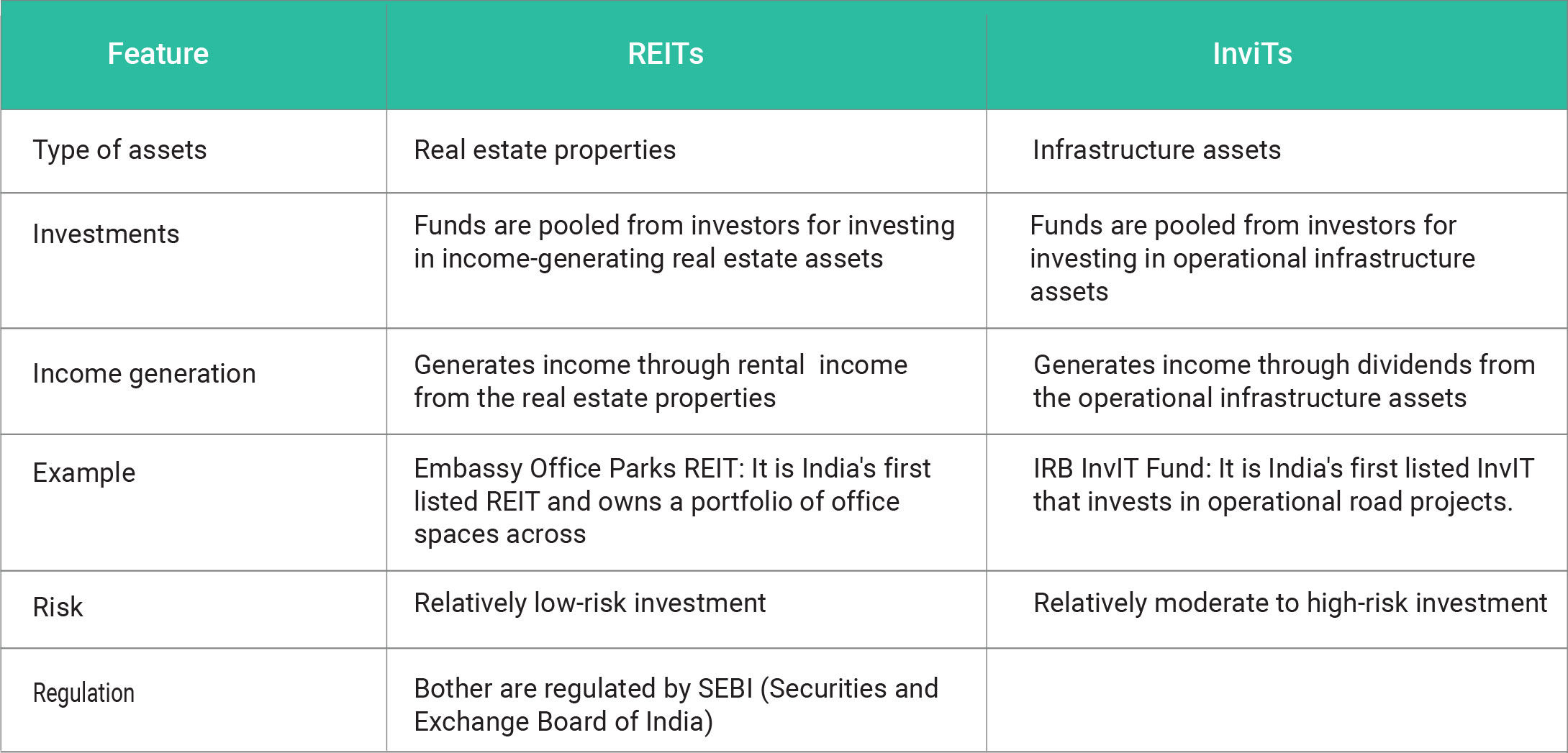

REITs and InvITs are conceptually akin to mutual funds,

where a sponsor raises capital and invests in

infrastructure or real estate projects. A Real Estate

Investment Trust (REIT) or an Infrastructure Investment

Trust (InvIT) is an investment vehicle that owns

revenue-generating real estate or infrastructure assets.

While REITs invest in real estate projects, InvITs focus on

infrastructure projects with a longer gestation period.

These trusts provide investors with exposure to

diversified, regular income-generating real estate and

infrastructure assets, making them strong financial

instruments for those seeking involvement in these

sectors.

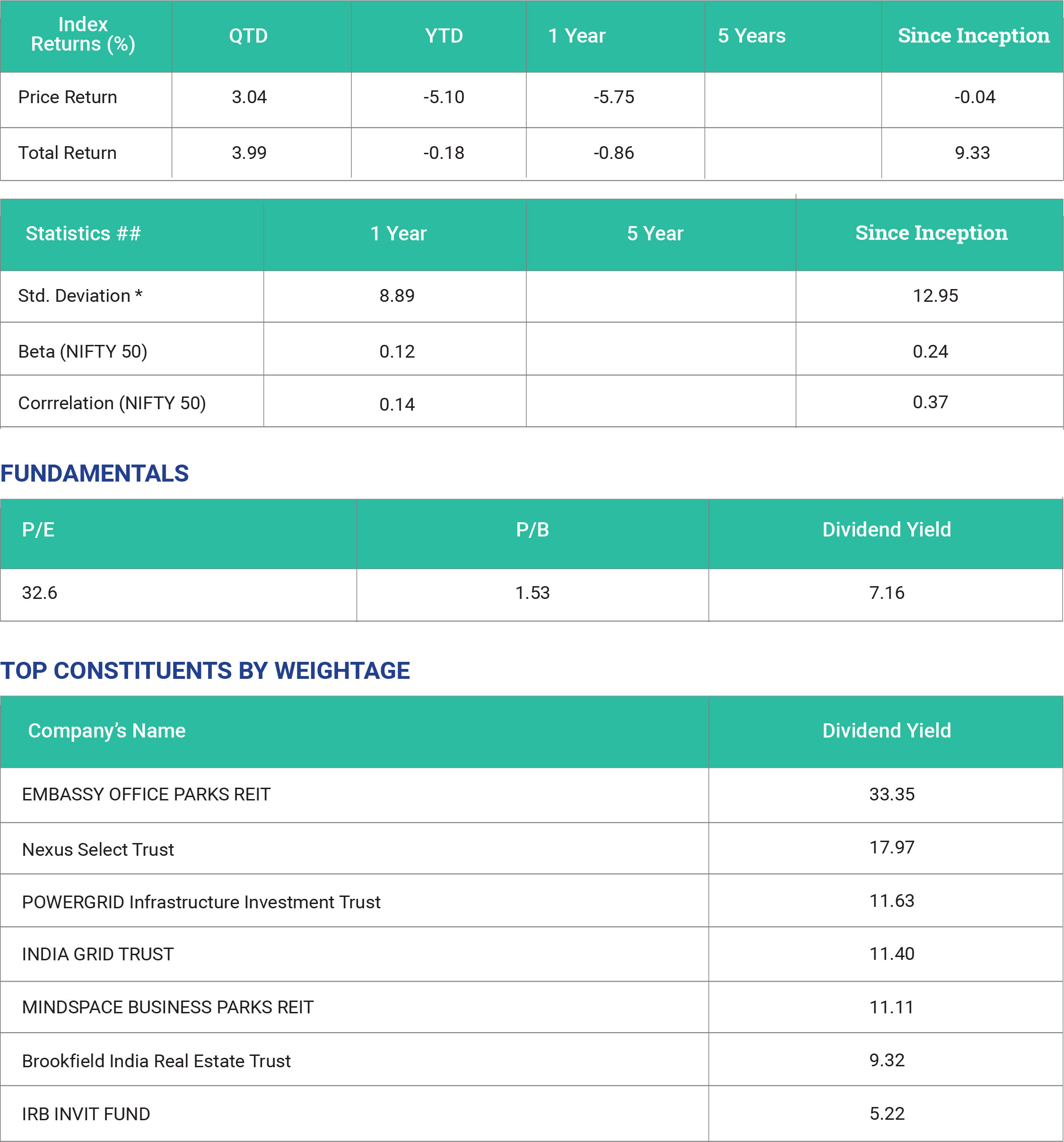

The Nifty REITs and InvITs index comprises securities

based on their free float market capitalization, subject to

a security cap of 33% each, with the aggregate weight of

the top three securities capped at 72%. The index has a

base value of 1,000 and undergoes quarterly reviews and

rebalancing. It serves as a benchmark for fund portfolios

and index variants.

For securities to be eligible for inclusion in the index, they

must meet certain criteria:

- REITs or InvITs must be domiciled in India and listed and traded on NSE; only publicly listed securities are eligible.

- Securities should have a market lot size of 1 unit for inclusion.

- A minimum listing history of 1 month as of the cutoff date is required.

- Securities should have a minimum trading frequency of 60% during the previous 3 months as of the cutoff date.

SEBI has consistently worked on strengthening the

regulatory framework for REITs and InvITs. To enhance

the efficiency of the public issue process, the time for

allotment and listing after the closure of REITs and InvITs

issues was reduced from 12 to 6 working days. For

privately placed InvITs, the timeline was shortened from

30 days to six working days, contributing to increased

market liquidity. According to SEBI, these innovative

mechanisms for financing real estate and infrastructure

can have a multiplier impact on India's economic growth.

SEBI has introduced rules granting special rights to REIT

unitholders, enabling them to nominate representatives

on the boards. Additionally, the concept of a

self-sponsored REIT was introduced. The market

continues to show interest in REITs and InvITs, with 3

new InvIT registrations and 1 new REIT registration

during 2022-23. The total registered entities now stand at

20 for InvITs and 5 for REITs. Listed REITs and InvITs

raised funds amounting to Rs 18,658 crore in the first

half of the current fiscal year, driven by robust demand

for infrastructure investment, attractive returns, and

supportive government policies. The data indicates that,

of this amount, Rs 12,753 crore was raised through

InvITs, and Rs 5,905 crore was collected via REITs. Tax

implications for REITs and InvITs are treated as

pass-through vehicles under income tax rules, with

income, in the form of dividends and interest from

underlying assets, being fully exempted. Distributions

made by investment trusts are directly taxed in the hands

of investors, depending on the nature of such

distributions (dividend, interest, or capital repayment).

It's worth noting that REITs and InvITs have different

income tax implications for sponsors, unitholders, and

the REIT or InvIT at various stages. With proactive

support from the government and regulatory authorities,

REITs and InvITs are being extensively promoted. High

levels of corporate governance from sponsors and

management are of utmost importance in establishing

these trusts. Maintaining consistent transparency in

financial reporting is crucial for building the foundation

for long-term success in this area. Given the sizeable

dependence of the Indian economy on infrastructure

development, these trusts have

become vital in addressing the country's infrastructure

needs. While REITs and InvITs are relatively new

concepts in the Indian market, they have been popular

choices in global markets due to their lucrative returns

and capital appreciation. This marks the advent of a new

era of growth driven by capital investments in REITs and

InvITs.

Copyright © 2021 Fintso