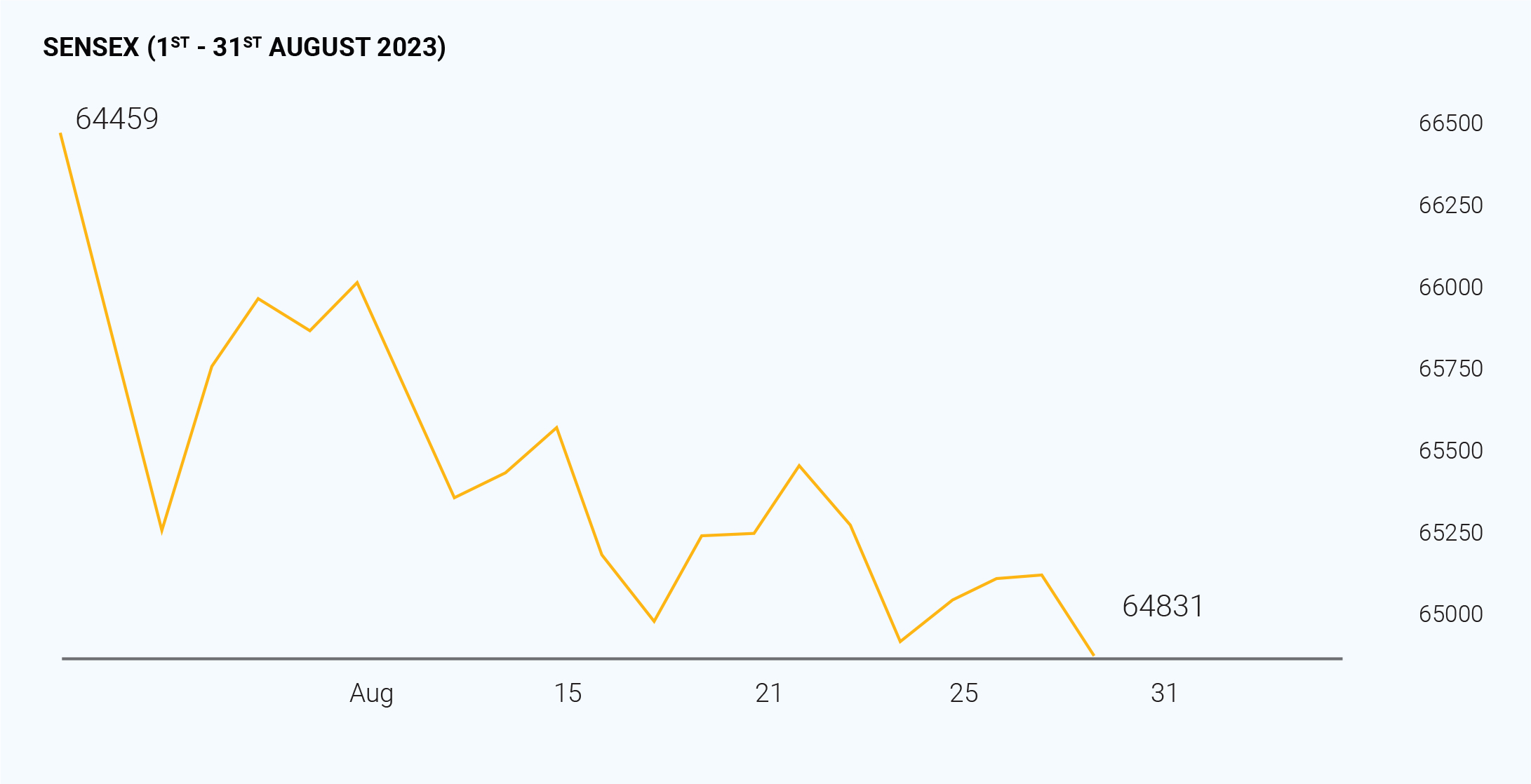

August starts with the bad news of Fitch downgrading the U.S. economy by one notch to ‘AA+’ from 'AAA' with a 'stable' outlook which led to an all-around sell-off in the global equity markets and rattled the investor risk sentiment. The rating downgrade can be attributed to the rising debt of the U.S. government, a decline in governance standards on fiscal and debt matters, and possible recession. Indian markets were driven mainly by international factors in the month of August. In the second week, the Chinese central bank, devalued its currency by 1.9%. This move rattled the financial markets all over the world again, Indian markets and currency also felt the tremors. Being the second largest economy in the world, the currency depreciation was an attempt to boost exports, where it was struggling to increase the output with massive overcapacity. Although China claimed that their economic growth is around 7% the experts suggested that it stands at 5%. Across the world again the markets dived low because of China. The Indian stock market, Sensex, fell in excess of 6% during the month. In fact, a fall of similar magnitude was seen on 24 August alone when the benchmark indices fell close to 6%, but the market recovered after that, it still ended the month with a sharp cut of about 6.5%. The China impact was seen in the currency market as well. The Reserve Bank of India (RBI), in its review of the monetary policy, decided to leave the policy rates unchanged. Inflation based on the consumer price index slowed to 3.78% for July. After the five-week market streak, August brings declines on the back of China's problems, a rise in commodities prices. FIIs sold about Rs. 17209.07 crores whereas DIIs brought around 16248.42 crores during the month. MPC in its review meeting keeps the rate unchanged in August. But MPC would be keeping a check on supply delays brought on by unfavorable weather, the consumer inflation rate which is projected to increase in the coming months. The skewed southwest monsoon's impact might be the potential El Nino effect, and pressures on global food prices owing to geopolitical hostilities, all are hazardous for our economy. The market expects a rate cut in the upcoming MPC review meeting on 29 September. Despite the impact of poor external demand, domestic demand is holding up well. However, corporate earnings are forecast to be buoyant in Q2 due to a moderation in international prices of fuel, metals, and chemicals and also festival demands. The upswing in retail inflation observed in July which is at 7.44%, needs to be monitored precariously due to its potential upward risk. An increase in inflation would make the market more volatile in the future.

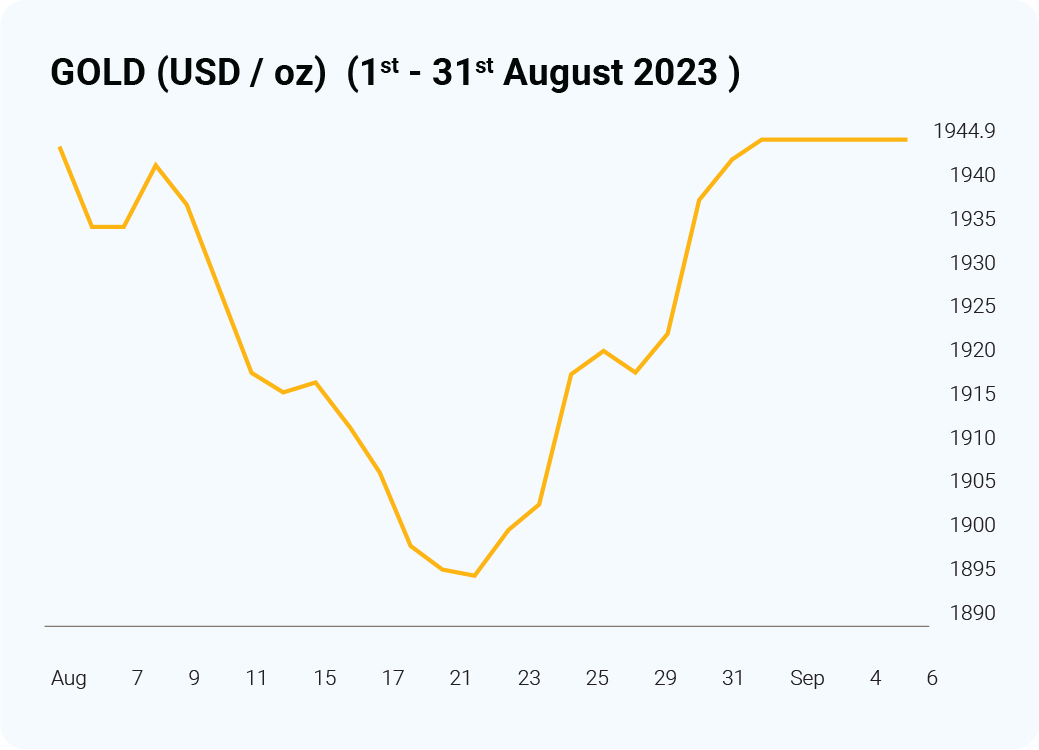

Gold gained internationally and domestically due to global financial and commodity markets instability. Gold gained around 3.5% in international markets, the rupee depreciation helped gold appreciate domestically. Gold seems to be safe haven for investors in this current volatile period. On the other hand, crude also witnessed

high volatility. Brent crude prices moved from $ 84 to the level of $88. With global uncertainty, the crude faces weak demand with higher production. US and China's economic slowdown pressurizes the demand for crude, in addition to that time-to-time production cut also keeps the crude volatile.

With RBI's unchanged rate, 10-year G sec rose marginally in the first week of August. India’s retail inflation rose to a 15-month high of 7.44% in July 2023, since the inflation numbers were high the yields came off. The retail inflation surges on the back of rising food prices and uneven rainfall across the country. The food inflation is expected to subside with fresh vegetable stock arrival and government measures. Rising crude prices,

geopolitical uncertainties, and global financial conditions are a few threats to Indian economic growth. Indian stock markets are likely to be rangebound with global uncertainties and without any major domestic triggers. The balancing act of FIIs and DIIs might prevail in the coming months. With global commodity prices falling India would benefit as a net importer, which would in turn help the companies to garner profits.